401k allocation calculator

Additionally you dont have to pay taxes when you make qualified withdrawals. With a 403b plan you can save money before you pay taxes on it.

How To Calculate The Annual Rate Of Return On A Bond Our Deer Bond Annual Finance Advice

Heres what you need to know to invest 401k money.

. Taxpayers under 59 12 were allowed to withdraw up to 100000 for COVID-19 reasons without having to pay a penalty. The Ohio State Tax Calculator OHS Tax Calculator uses the latest Federal tax tables and State Tax tables for 202223To estimate your tax return for 202223 please select the 2022 tax year. The CO Tax Calculator calculates Federal Taxes where applicable Medicare Pensions Plans FICA Etc allow for single joint and head of household filing in COS.

401k Save the Max Calculator. You can contribute up to 20500 in 2022 up 1000 from last year. Discover your 401k Rollover Options.

The Colorado tax calculator is updated for the 202223 tax year. You fund this account by contributing a set percentage of your paycheck into the account. What is a 403b.

Selecting an asset allocation in your 401k is one of the first steps of retirement planning. A 403b is a retirement savings plan for employees of nonprofits like universities. 1 With Fidelity you have a broad range of investment options including.

Loan Amount Interest Rate per year. 401k Save the Max Calculator. For the 10-year period ended December 31 2021 7 of 7 Vanguard money market funds 67 of 86 Vanguard bond funds 21 of 24 Vanguard balanced funds and 128 of 183 Vanguard stock fundsfor a total of 223 of 300 Vanguard fundsoutperformed their Lipper peer group.

One of the biggest perks of a 401k plan is that employers have the option to match your contributions to your account up to a certain point. As an investor-owner you own the funds that own Vanguard. 529 Savings Plan Overview 529 State Tax Calculator Learning Quest 529 Plan Education Savings Account Custodial Account Overview.

Use our Retirement Savings Calculator. Were here to help Call 866-855-5635 Chat Professional Answers 247 Visit Find a Schwab branch near you. Credit Card Minimum Calculator Auto Loan and Lease.

Asset Allocation Mutual Funds. Annuity Calculator Credit Card Credit Card Payoff Calculator. For example if you have 100000 invested in the stock market perhaps through your employers 401k and 25000 saved in your emergency fund then you should enter 125000 in this field.

Youve got lots of options for planning your retirement paycheck. A 401k is an employer-sponsored tax-advantaged retirement plan. The Colorado income tax calculator is designed to provide a salary example with salary deductions made in Colorado.

Also includes allocation formulas for the automatic Lifecycle L Funds. A Roth IRA can be a powerful way to save for retirement since potential earnings grow tax-free. Learn how to roll over your old 401k into an IRA to maximize your benefits.

The final tool is the easiest to use. Loan Calculator Required field. For example a 30-year-old.

Also you can save the data on your computer or mobile phone or upload this into to the calculator to save you time when you next run a scenario. You can quickly estimate your Ohio State Tax and Federal Tax by selecting the tax year your filing status Gross Income and Gross Expenses this is a great way to compare salaries. Asset Allocation Mutual Funds Target Date Mutual Funds Commodity Mutual Funds.

This calculator uses your input allocation percentages and rate-of-return for each to calculate a weighted-average rate-of-return for your net worth as. Traditional IRA vs Roth IRA. Rollover IRA401K Rollover Options Combining 401Ks.

401k plans are one of the most common investment vehicles that Americans use to save for retirement. Transferring tax advantages fees and more. To help you maximize your retirement dollars the 401k is an employer-sponsored plan that allows you to save for retirement in a tax-sheltered way.

Thrift Savings Plan Calculator Calculate how much will your TSP deposits and future savings will be worth in 5 10 or 20 years. Many Americans best chance at retiring comfortably lies in their 401k which is purposely confusing forcing us all to fend for ourselves when it comes to understanding and investing in our future. The Vanguard Retirement Nest Egg calculator is designed to tell you the odds of your nest egg lasting in.

If you have a 401k you leave your money at work in mutual funds or index funds earning higher returns. For years people could rely on pensions and social security for retirement both of which are scarce options today. With this rule you subtract your age from 100 to find your allocation to stock funds.

Vanguard Retirement Nest Egg Calculator. Retirement plan income calculator. Heres how it affects your tax return.

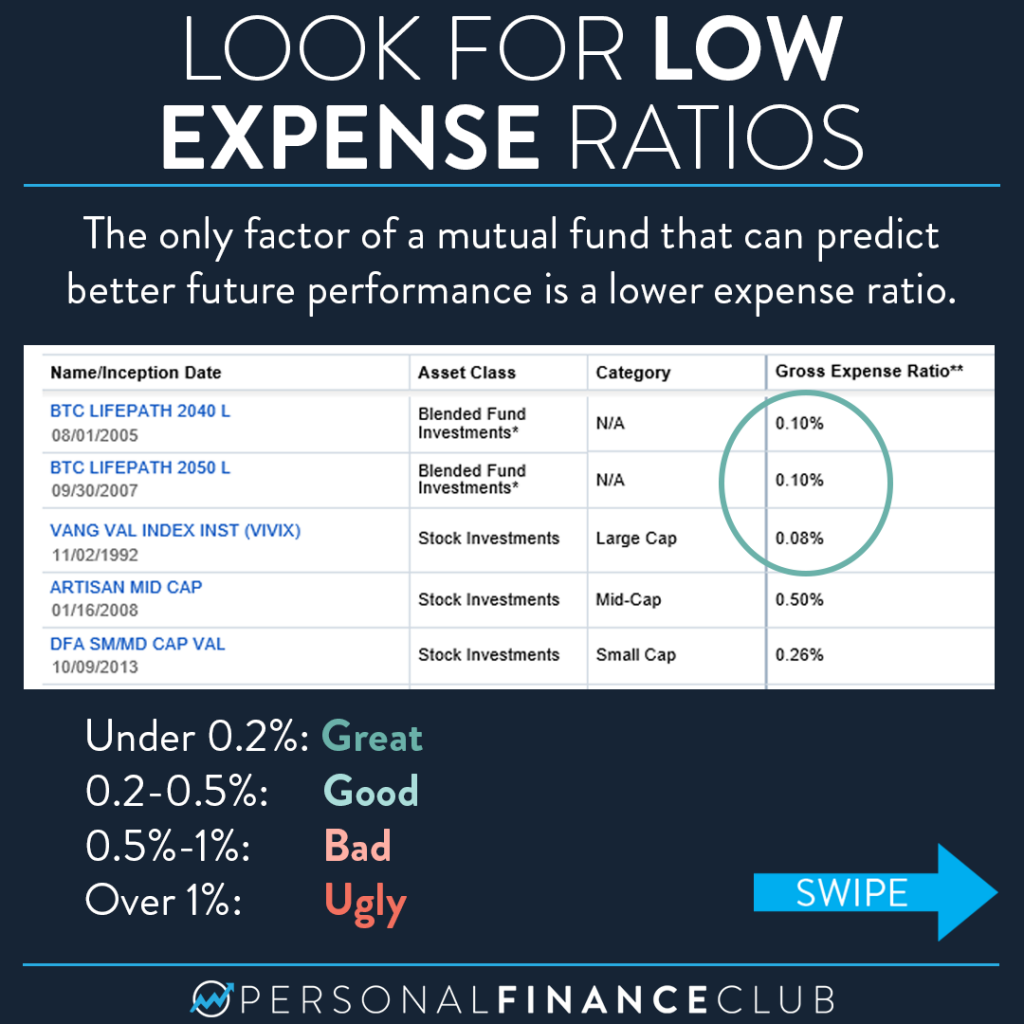

How To Pick Your 401k Investments Personal Finance Club

The Only Reasons To Ever Contribute To A Roth Ira It S Generally Better To Never Pay Taxes Up Front If Yo Finance Blog Wealth Management Funny Marriage Advice

Pin Page

401 K Allocation Model Model Investing

Different Methods To Navigate A Fluctuating Commercial Real Estate Market Commercial Real Estate Marketing Commercial Property Commercial Real Estate

How To Protect Your Retirement Savings Fidelity Investments Investing Investment Portfolio Saving For Retirement

Max Out 401 K 401k Investing Investing Personal Finance Advice

How To Invest Your Ira Fidelity Investing Investment Portfolio Saving For Retirement

The Maximum 401k Contribution Limit Financial Samurai

401k Contribution Limits And Rules 401k Investing Money How To Plan

Personal Finance Spreadsheet Bundle Google Sheets Etsy In 2022 Personal Finance Finance Emergency Fund

What If You Always Maxed Out Your 401k Money Saving Plan Money Plan 52 Week Money Saving Challenge

Alternative Traditional Investment Tracking In One Place Investing Investing Money Track Investments

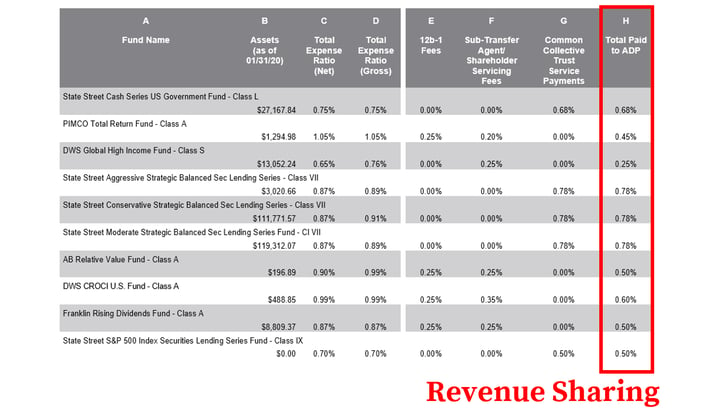

How To Find Calculate Adp 401 K Fees

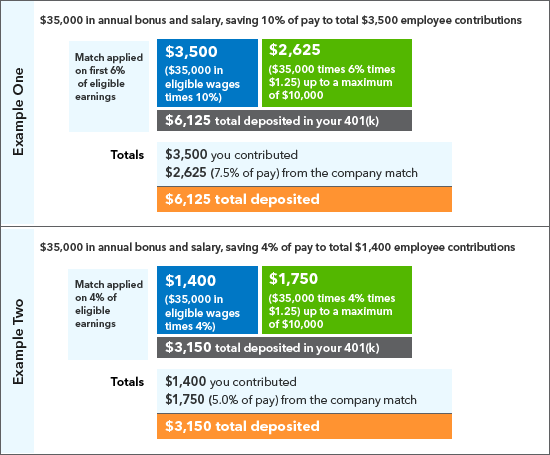

401 K Savings Plan Intuit Expert Benefits

How Much Can I Contribute To My Self Employed 401k Plan

How Much Should I Have Saved In My 401k By Age